Table of Contents

- Australian income tax brackets 2021 - golfdeco

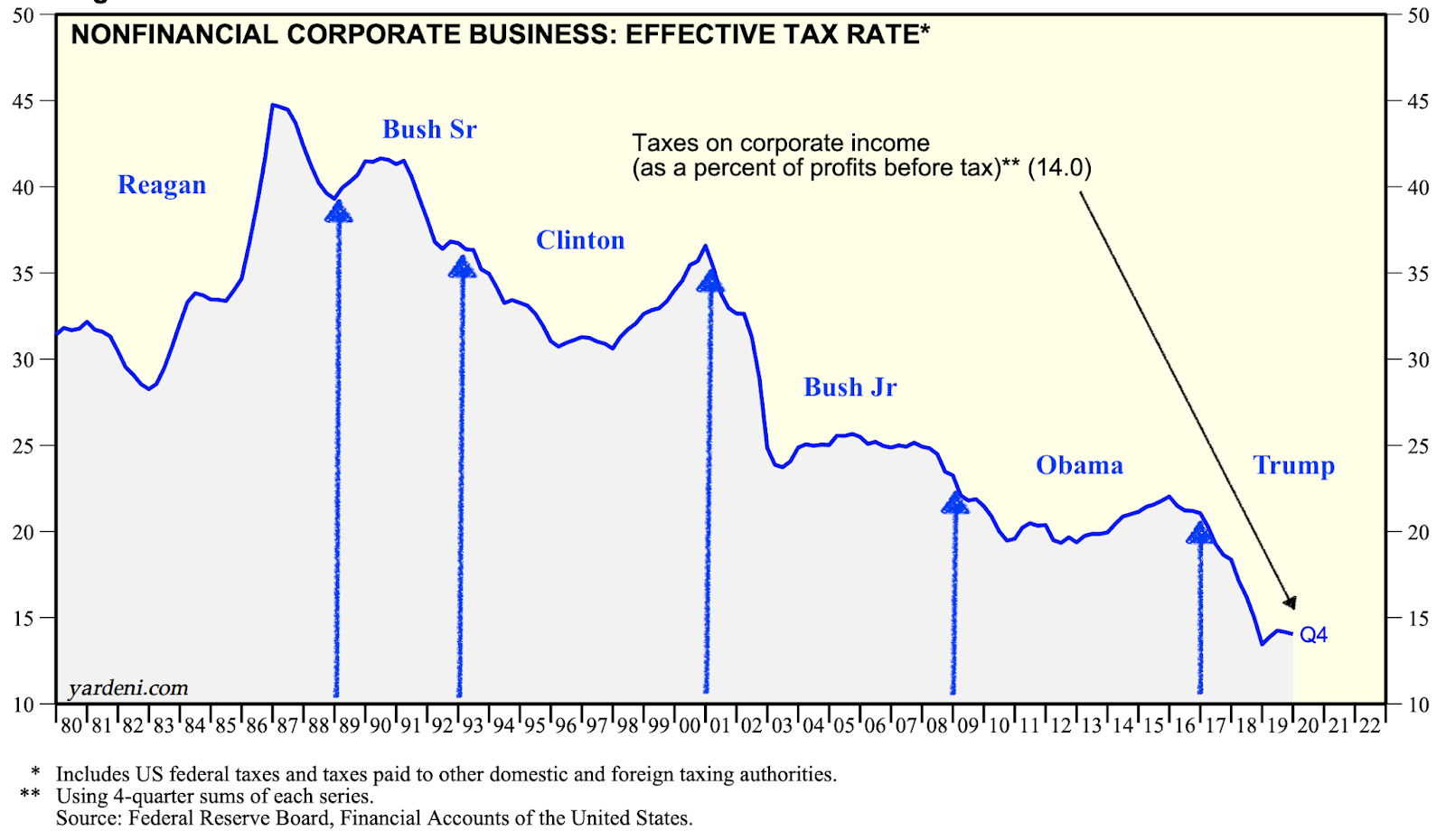

- Australia's tax rate increase was the biggest in the world last year ...

- Australian income tax brackets and rates (2024-25 and previous years)

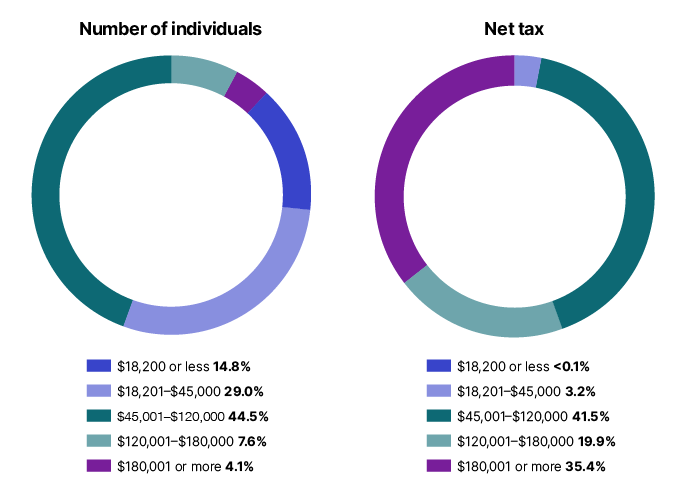

- Individuals statistics | Australian Taxation Office

- Tax Brackets Australia 2023, Tax Rates List - urbanaffairskerala.org

- Australian Personal Tax Rates 2024 - Printable Online

- 2025 Tax Tables for Australia

- Stage three tax cuts: Bracket creep will put 1m Aussies into top tax ...

- Australia's Average Tax Rate Increase Leads OECD Countries Due to ...

- Individuals | Australian Taxation Office

Australia's 2025 Tax Brackets

New Zealand's 2025 Tax Brackets

Key Takeaways and Planning Strategies

To make the most of the new tax brackets, it's crucial to understand how they'll impact your tax liability. Here are some key takeaways and planning strategies to consider: Tax deductions and credits: Ensure you're taking advantage of available tax deductions and credits, such as charitable donations, medical expenses, and education expenses. Tax-efficient investments: Consider investing in tax-efficient assets, such as superannuation funds or tax-loss harvesting, to minimize your tax liability. Income splitting: If you're a high-income earner, consider income splitting with your spouse or partner to reduce your tax burden. In conclusion, the 2025 tax brackets in Australia and New Zealand offer a range of opportunities for taxpayers to minimize their tax liability. By understanding the new tax rates and brackets, you can make informed decisions about your tax planning strategy and ensure you're taking advantage of available tax deductions and credits. Remember to consult with a tax professional or financial advisor to ensure you're meeting your tax obligations and maximizing your tax savings.This article is for general information purposes only and should not be considered as tax advice. It's essential to consult with a tax professional or financial advisor to ensure you're meeting your tax obligations and maximizing your tax savings.